child tax credit september 2021

Ad The new advance Child Tax Credit is based on your previously filed tax return. SOME cash-strapped families were left waiting for their 300 stimulus check after a technical issue caused Septembers child tax credit payments to be delayed.

With Monthly Payments Stalled Congress Needs To Act Center On Budget And Policy Priorities

This third batch of advance monthly payments totaling about 15 billion is reaching about 35.

. We need this money. Ad Free tax support and direct deposit. Under the American Rescue Plan of 2021 advance payments of up to half the 2021 Child Tax Credit were sent to eligible taxpayers.

Eligibility Rules for Claiming the 2021 Child Tax Credit on a. September 28 2021 1027 AM MoneyWatch. The credits scope has been expanded.

Understand that the credit does not affect their federal benefits. September 17 2021. Millions of families across the US will be receiving their.

September Advance Child Tax Credit Payments. The American Rescue Plan allowed 17-year-olds to qualify for the Child Tax Credit. Parents report problems receiving September child tax credit Published Fri Sep 17 2021 318 PM EDT Updated Fri Sep 17 2021 729 PM EDT Alicia Adamczyk AliciaAdamczyk.

September child tax credit. The American Rescue Plan Act ARPA increased the 2021 child tax credit from 2000 to 3600 for children under age 6. The IRS issued a formal statement on September 24 which anyone missing their September payment should read.

Many eligible taxpayers received monthly advance payments of half of their estimated 2021 Child Tax Credit amounts during 2021 from July through December. The IRSs statement reads. September child tax credit still not issued.

Previously only children 16 and younger qualified. September 16 2021 735 AM MoneyWatch. Find out if your child or dependent qualifies you for the Child Tax Credit or the Credit for Other Dependents.

2021 Child Tax Credit and Advance Payments. During the week of September 13-17 the IRS successfully delivered a third monthly round of approximately 35 million advance Child Tax Credits CTC totaling 15 billion. WASHINGTON The Internal Revenue Service and the Treasury Department announced today that millions of American families are now receiving their advance Child Tax Credit CTC payment for the month of September.

Even though child tax credit payments are scheduled to arrive on certain dates you may not have gotten the money. How much will parents receive in September. For the 2021 tax year only the child tax credit has been raised from the original 2000 child tax credit which was only sent for children age 16 or younger.

The 2021 Child Tax Credit was increased up to 3600 for children under age six and 3000 for those six to 17. Qualified children ages five and under may count for up to 3600 up to 300 per month from July through December. Child tax credit september 2021 payment date.

Some parents may not want to get the monthly payments particularly if their incomes increase this yearThe payments are credits toward families tax liability for 2021 but are based on 2020 or. The total child tax credit for 2021 is 3600 for each child under 6 and 3000 for each child 6 to 17 years old. 601 ET Sep 29 2021.

IR-2021-188 September 15 2021. Though the Internal Revenue Service sent out the third monthly child tax credit payment last week some families are still waiting for the funds. The third monthly payment of the enhanced Child Tax Credit is landing in bank accounts.

We are aware of instances where some individuals have not yet received their September payments although they received payments in July and August. 1017 ET Sep 15 2021. IRSnews IRSnews September 18 2021.

It provides information about the Child Tax Credit and the monthly advance payments made from July through December of 2021. While the latest installment of the 2021 Child Tax Credit payments was issued by the IRS on Sept. We are aware of instances where some individuals have not yet received their September payments although they received payments in July and August.

2021 payouts by age. Understand how the 2021 Child Tax Credit works. RIRS Reddit 9.

Total child tax credit payments between 2021 and 2022 could be up to 3600 per kid. The Child Tax Credit phases out in two different steps based on your modified adjusted gross income AGI in 2021. The 2021 advance monthly child tax credit payments started automatically in July.

That means parents who. Checks were supposed to be sent out on September 15 and millions of Americans were due to receive the cash days later. The advance is 50 of your child tax credit with the rest claimed on next years return.

Chris Walker 37 a journalist in Madison Wisconsin told CBS MoneyWatch he was expecting a 250 Child Tax Credit payment for his 13-year-old son. 15 some families are getting anxious that they have yet to receive the money according to a. If you received advance payments you can claim the rest of the Child Tax Credit if eligible when you file your 2021 tax return.

The first phaseout can reduce the Child Tax Credit to 2000 per child. If you do not receive a monthly child tax credit payment the IRS will adjust your remaining payments to ensure you receive the total amount due to you for 2021. ITA Home This interview will help you determine if a person qualifies you for the Child Tax Credit or the Credit for Other Dependents.

RIRS Reddit 7. This week the IRS successfully delivered a third monthly round of approximately 35 million Child Tax Credits with a total value of about 15 billion. The Child Tax Credit Non-Filer Sign-Up Tool is to help parents of children born before 2021 who dont typically file taxes but qualify for advance Child Tax Credit payments.

While the latest installment of the 2021 Child Tax Credit payments was issued by the IRS on Sept. My Child tax credit late and 188 for September. September child tax credit money arrives but some say IRS.

Get the Child Tax Credit. Find out if they are eligible to receive the Child Tax Credit.

Tax Credits Payment Dates 2022 Easter Christmas New Year

Child Tax Credit Publications Columbia University Center On Poverty And Social Policy

Child Tax Credit 2021 8 Things You Need To Know District Capital

Tax Changes For Individuals In The American Rescue Plan Act The Cpa Journal

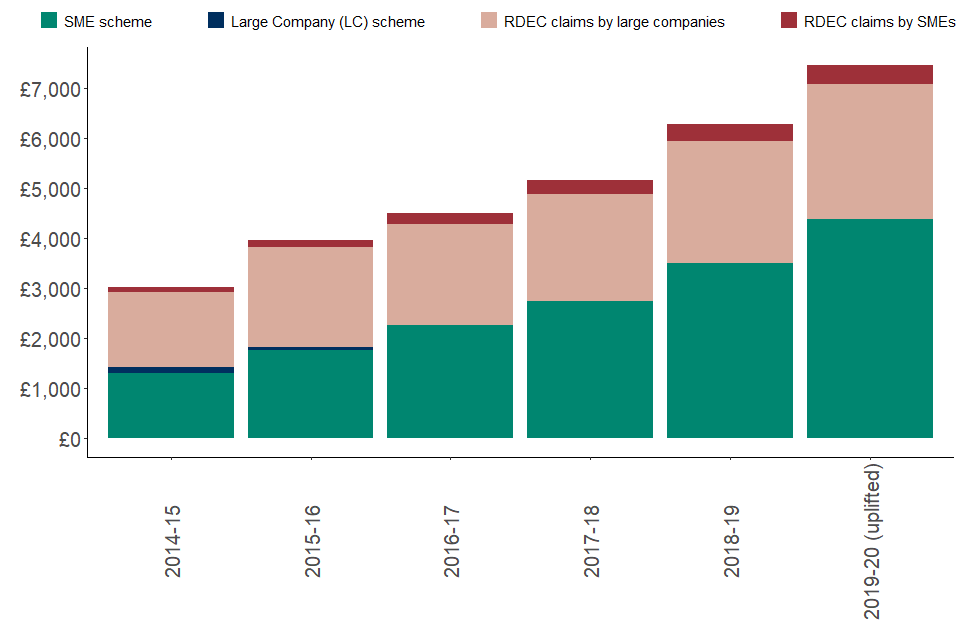

Research And Development Tax Credits Statistics September 2021 Gov Uk

Irs Issues Employer Guidance On Covid 19 Paid Leave Tax Credits Cupa Hr

Expanded Child Tax Credit Continues To Keep Millions Of Children From Poverty In September A Columbia University Center On Poverty And Social Policy

Child Tax Credit 2021 8 Things You Need To Know District Capital

Expiration Of Child Tax Credits Hits Home Pbs Newshour

How To Claim The Child Tax Credit For A Baby Born In 2021 Goodrx

Child Tax Credit 2021 8 Things You Need To Know District Capital

Tax Credits And Coronavirus Low Incomes Tax Reform Group

With Monthly Payments Stalled Congress Needs To Act Center On Budget And Policy Priorities

2021 Child Tax Credit Here S Who Will Get Up To 1 800 Per Child In Cash And Who Will Need To Opt Out Cbs News

2021 Child Tax Credit What It Is How Much Who Qualifies Ally

Child Tax Credit 2022 Schedule 4 000 Checks Available Now In New Program See How You Can Apply For The Checks

Child Tax Credit 2021 Payments How Much Dates And Opting Out Cbs News

December S Payment Could Be The Final Child Tax Credit Check What To Know Cnet